Hi Crypto fans, this time I will discuss about HADA-DBANK. HADA-DBANK is the first digital bank to link sharia banking with BlockChain Technology, to make ethical banking an ecosystem and responsible.

the concept of banking and financial institutions today is quite detrimental to customers not only because the money savings that each month cut. but also, administrative processes that require a lot of requirements if you want to apply for a loan and then the results of the loan still have to be cut for administrative reasons. therefore to avoid it all HADA-DBANK is a solution to the problems gained by customers over the years.

HADA-DBANK has VISION and MISSION as follows:

VISION

Becoming The Leading Global Blockchain & Digital Bank Maintaining Ethics and Responsibility for Sharia Banking Principles and Services

MISSION

Provide Ethical and Responsible Banking Services to everyone, to the current "Unbanked" population

HDBNK Digital Bank will be the first block channel in the world to integrate sharia banking module with BlackChan technology, to make ethical banking as ecosystem and responsible. Due to the current digital channels and bank blocks, newly established banks are focused on traditional banking services, we have decided to win sharia banking services due to the lack of such facilities. In 2016, sharia banking is around $ 1.5 trillion worldwide.

Comparison between Islamic Bank and Conventional Bank

Islamic Bank

Money is not used as a commodity although used as a medium of exchange and selling value. Therefore, it can not be sold for a certain price or leased.

Islamic banks benefit from trade in goods or filling

for the services provided

Sharia banks operate on the basis of profit and loss sharing. In cases where an entrepreneur loses, the bank will divide this loss based on the way in which the financing is used.

Implementation of the agreement is a must for sharia banks to exchange goods and services.

Sharia banking creates a relationship with the real sector of the economic system by investing in trading activities. Hence, the funds are linked to physical assets, enabling banks to directly contribute to economic development.

Conventional Bank

Money is used as a commodity in addition to being a medium of exchange and a store of value. Therefore, it can be sold at a price higher than its nominal value and can also be leased.

Conventional banks use the time value as a basis to charge interest on capital for profit

Interest is imposed even in the case of organizations that suffer losses by using bank funds. Therefore, it is not based on the sharing of profits and losses

While disbursing cash, financing, or working capital, there is no agreement to exchange goods and services

Conventional banks use money as a commodity that leads to inflation.

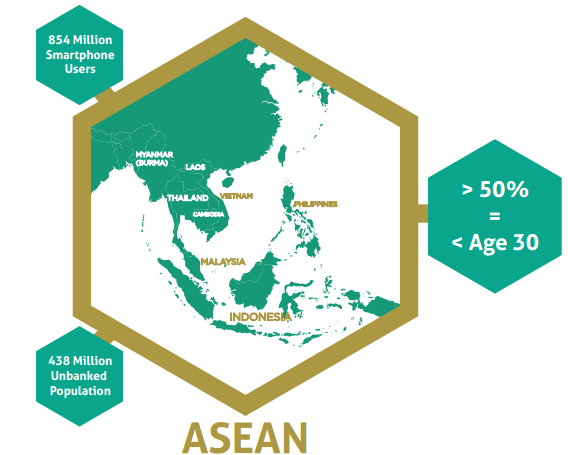

Interesting facts about ASEAN:

1. Have a population that is not budgeted about 438 million.

2.More than half of the population in ASEAN is under 30 years of age.

3.Have a market penetration of 854 million smartphones or 133% compared to the population, but only 53% of ASEAN population is online, leaving significant space for future market expansion in Indonesia.

As a special bank Online, this fact convinces us to focus on ASEAN as our secondary market. We are scheduled to offer our Syariah Banking Services gradually in the second Quarter of 2018.

TIM HADA-DBANK.

if friends are interested in this program please visit:

website: https://www.hada-dbank.com/

whitepaper: https://drive.google.com/file/d/16nbPwXqjXRRmVKstu1dn4NobywANASkH/view

AUTHOR: Gunting

https://bitcointalk.org/index.php?action=profile

Tidak ada komentar:

Posting Komentar